Once you’ve set your post-FI lifestyle goals, the next step is to identify your “FI Number”. Your FI Number is the number of assets you have (i.e. stocks, real estate, cash) minus liabilities you owe (debts such as credit card balance, mortgage, and student loans) and represents the net worth you should have to declare yourself financially independent.

We set the FI Number by multiplying the amount of money we spend each year, called “Annual Spend”, by 25. To get to the same number, you can live off of 4% of your net worth annually.

For example, if you spend $30,000 per year on housing, transportation, travel, food, and everything else you need and want to live on, your FI Number would be $750,000. Four percent of $750,000 is $30,000.

The 4% rule

Why 25 times your Annual Spend? According to Investopedia,

The 4% Rule is a practical rule of thumb that may be used by retirees to decide how much they should withdraw from their retirement funds each year.

The purpose of adopting the rule is to keep a steady income stream while maintaining an adequate overall account balance for future years. The withdrawals will consist primarily of interest and dividends on savings.

Historic stock market performance shows that between stock market growth in the form of capital gains, dividends, and interest, you can annually withdraw 4% of your total net worth without reducing your net worth.

This 4% accounts for both inflation and periodic market downturns, including crashes. Some economists argue that 4% is actually too conservative and that 5% is more accurate, but for argument’s sake and to satisfy the more financially conservative among us, we use the 4% rule as a starting point.

Calculating your annual spend

Before you can multiply your annual spend by 25, you have to know what that spend is. You can calculate your yearly spending by adding up all of your expenses. It’s important to include both recurring expenses like rent payments, phone bills, and groceries as well as one-off expenses such as that new winter jacket, that new cell phone, and flowers for your front garden.

Tools of the trade

The best way to do this is to use a personal finance application such as YNAB (which Meghan talks about here), Mint.com, or Personal Capital. Each of these applications allows you to link your bank accounts, and then auto-import your transaction history—aggregating all your transactions from (possible) multiple credit cards, Venmo, and direct deposits/withdrawals into one place.

I personally use Mint.com and have used Personal Capital in the past.

Of course, you can always create your own spreadsheet—and maybe you do to perform further analysis. To get started, however, I’ve found that using the above tools to automate the transaction aggregation is a critical value-add.

Add up all expenses

Once you have all your accounts imported and have one year of history, add up all the expenses you had in the last year. Feel free to leave out reimbursable expenses such as airfare bought for a work trip that your company paid you back for.

This sum (less reimbursable expenses) is your annual spend.

No Judgement (yet)

If you’re like me, this number might be higher than predicted. Diving into my data I learned that though my recurring expenses (food, housing, etc.) are quite low, my “one-off” purchases for hiking and climbing were not so “one-off”. That’s okay! For now…

Remember, right now your goal is to simply calculate your annual spend so you can calculate your FI Number. There will be plenty of time to trim up your budget (and re-calculate your FI Number!!) down the road.

How does other income affect your FI number?

Most people don’t want to actually retire once they hit their FI number. Hard-working, driven people—like those in the FI community—tend to stay busy and productive throughout their lives.

This is why I take issue with the acronym FIRE (Financial Independence, Retire Early). It implies that once you hit FI, you retire. You may want to actually retire for a time, but most are just looking for flexibility and freedom in their lives.

Most in the FI community still generate income, and many actually end up increasing earned income after reaching FI.

If you are calculated about this, this means you may be able to reduce your FI number. Let’s look at two examples.

Example 1: Real estate supplemental income

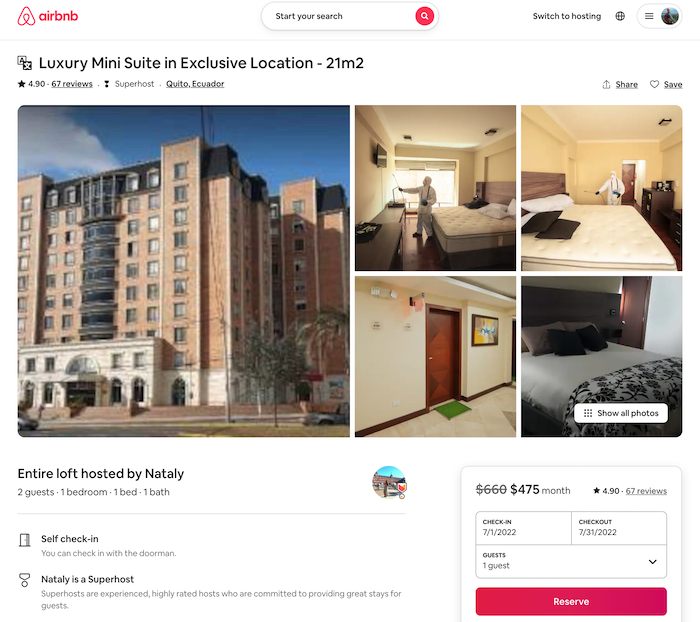

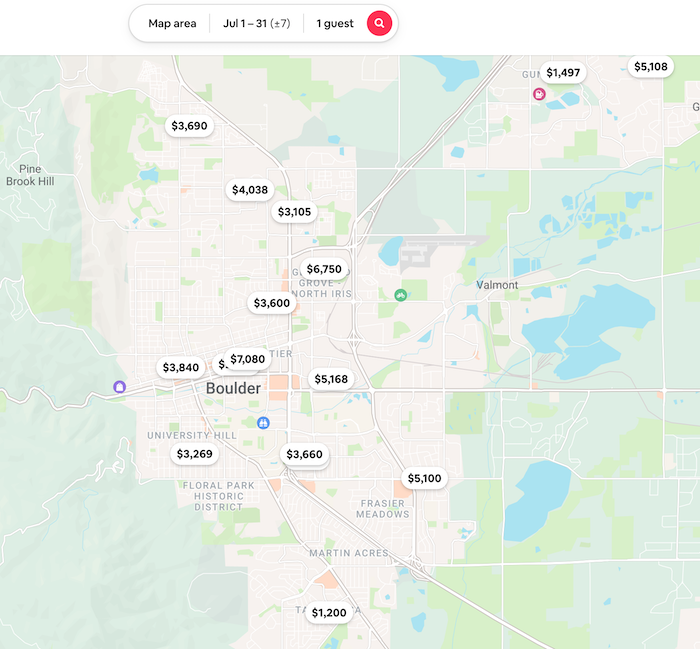

Let’s say you own your own home in Boulder, CO. Boulder is a desirable place to live and it is a year-round vacation destination for climbers, hikers, and skiers. When you travel, you like to take advantage of “Geo-Arbitrage” (leveraging travel to less expensive parts of the world like South or Central America, East Asia, or Eastern Europe to reduce costs over your home town in an expensive place like Boulder, New York City, or London) to save money on housing and you make money by renting out (via VRBO or Airbnb) your house while you’re gone.

In a nice but very inexpensive city like Quito, Ecuador, you can find a luxury apartment for $475 per month.

In Boulder, your house might rent out for $4,000 to $7,000 per month.

This is a CRAZY difference in price. If you were to do something similar to this a few months out of the year, you might be able to take home a net income of ~$30,000 per year.

Additionally, you’d be able to write off a lot of your housing expenses against this $30,000 of income. We’ll chat more about tax optimization in future posts!

Example 2: What if I like my job?

You (like me) actually like writing code! You just don’t like being told where or when to do it. As mentioned above, if it’s nice out on a Tuesday, you want to be able to go outside and not be beholden to some corporate rule about the number of vacation days you can take.

What if you can still code, but do so with a flexible schedule. Maybe even work remotely…

According to Glassdoor, the average salary for a mid-level software engineer in the US is over $110,000 (or roughly $55 per hour).

Let’s say you’ve built a good reputation and are competitive in the job market. You can be very selective about the company you work for and the benefits that the company provides. Critically, because you like coding, but no longer need to make money, you can trade a portion of my salary for flexibility.

With some persistence, you find a part-time side hustle that pays way below the market rate at $30 per hour (or roughly $60,000 per year if you work full time) that allows you to work part-time—say 20 hours per week. If you also take two weeks per year completely off, this gives you ~$30,000 of income that you enjoy making.

One big caveat

The keyword here is enjoy. The whole point of FI is to have enough money to live out your ideal lifestyle. If you like programming, great! But you should enjoy every aspect of the work, including: the projects you work on, the team you spend time with, and the schedule you’re asked to work. It should be a passion project, not a job.

Other ideas

Obviously, this does not just apply to coding or AirBnB. These examples are similar to two of the side-hustles I’ve picked up. Here are some other ideas:

Maybe you like carpentry, but don’t like working for a big construction contractor and you decide to start your own gig.

Maybe you love helping people optimize their finances, but don’t want to be an accountant anymore. You could become an IRS enrolled agent and volunteer to help people optimize their taxes.

You’re a busy journalist for your city’s newspaper. You love writing but are sick of intense deadlines and competitive culture at the paper. You could start your own blog or newsletter and publish articles on your own schedule.

Adjusted annual spend

Earned income in retirement can dramatically reduce your FI Number. There are many ways to do the accounting on this.

One way would be to take this after retirement annual income and subtract it from your annual spend. We’ll use the $60,000 as a sample (very high) annual spend.

$60,000 (annual spend) – $30,000 (post-retirement income) = $30,000 adjusted annual spend

This would cut your FI Number in half from $1.5m (25 x $60,000) to $750k (25 x $30,000).

You don’t have to be a millionaire to retire.

Technically, if you still need to pull in external cash to fund your lifestyle, you’re not financially independent. However, I’m willing to argue that you’re well on your way to FI if you’ve made some tweaks to how you make money that make you happier now, versus slaving away at a job you don’t like for another several years.

Through the above examples, I want to throw a spotlight on some of the nuance and opportunities that exists in the FI community.

Final thoughts

It’s so easy to focus on your FI Number and what you want your net worth to be in order to retire and lose sight of what you want your life to look like. You need to determine for yourself what that life looks like and, importantly, if you’re likely to be making any money once you do “retire”.

With some thoughtfulness and goal-setting, Financial Independence might be a lot closer than you think!