Earlier this year, I lost my job.

The timing was confusing—they’d just taken us all on a multi-day retreat in Chicago two weeks earlier.

Despite that, my spidey senses were firing. I knew something was up, and I confirmed my suspicions when our HR manager and CEO called me for a surprise meeting. I felt a deep sense of shame and loss when they told me I was one of four employees in the lay-off. Then I realized I’d be losing the fantastic health insurance I’d enjoyed for the last two years.

Woes of the open healthcare marketplace, and falling back into the warm embrace of an employer-sponsored plan

In the days that followed, I told a number of friends how losing my job was rough. But losing health insurance was the real loss.

Back on my old plan, I’d been seeing my physical therapist for a few months for a knee injury—each visit only cost me $5. Both my husband and I were both able to see our mental health therapists for free. It was some of the best healthcare insurance I’d ever had, and I was devastated to let it go.

I called up our healthcare broker and set my husband and myself up with a plan on the open market. The new plan would cost over double what we’d been paying before, with a sky-high deductible and very few benefits. I paid nearly $700 for the first bill.

Luckily, it was short-lived. I found a new job six weeks after my layoff and returned to the warm embrace of employer-sponsored health insurance.

Choosing a health insurance plan: Analysis paralysis

The plan options with my new employer weren’t quite as good as my previous employer’s.

There were three total options I was considering. My primary decision factors were the premium, deductible, and cost for specialists (physical therapy, mental health, i.e.).

| Premium | Deductible | Specialist Visit |

| $189 | $6350 | $0 after deductible is met |

| $438 | $1500 | $70 per visit (regardless of deductible) |

| $598 | $300 | $40 per visit (10% coinsurance after meeting deductible) |

I had just a couple of weeks to make a decision, and I truly agonized over which plan to choose. I’ll go through each, looking at the pros and cons of picking a low-premium, high-deductible plan vs a high-premium, low-deductible plan.

Option A: Low-cost premium with a high deductible

My husband and I dubbed this option the “self-insure” option. We have a $20,000 emergency fund that we figured we could dip into if need be. I loved that we would only be paying around $200 per month with this plan, and justified that we’re both young and healthy and unlikely to need anything major, medically speaking.

The downside to this option was zero coverage for anything specialist-related. No physical therapy, mental health, or other specialists, such as dermatologists.

Option B: Mid-cost premium with a lower deductible

This plan felt like the safest option. We’d be covered with a lower deductible if anything major happened, and we’d still be paying less than if we were on the open marketplace (which would have been closer to $650). We didn’t really like the $70 specialist visit, but it seemed reasonable when a typical visit to a physical therapist could be upwards of $150 without insurance.

Because we’re climbers and tend to be always coping with some niggling issue, we use PT fairly frequently. $70/visit could really add up if you were to go every week. However we recognized we could use this a few times per year without it making a huge dent in our finances.

Option C: High-cost premium with very low deductible

Even though this plan was the most expensive at $600, I was very tempted by the $300 deductible. I realized we’d meet our deductible quickly and then be able to enjoy much cheaper physical therapy and other specialist visits right away. Even so, the higher premium gave us both pause.

Mathing it up

At first, I wanted to go with Option C. I loved the idea of being fully covered for almost everything. I was beginning to justify it based on what we had been paying on the open marketplace.

On the other hand, a really low premium would help us save more each month. We figured we could always dip into our emergency fund if one of us spontaneously broke a bone.

So we did what Kristy Shen from Quit Like a Millionaire recommends and mathed that shit up.

For premiums only, Option A would cost just $2,268 for an entire year. Option B would be $5,265, while Option C would cost $7,176.

Option C, while great on paper for specialist visits, would require us to pay an extra $400 per month over and above Option A. We could have seen our therapists, PTs, and other specialists for a small fee each time, but we’d pay hundreds extra upfront each month just for the option.

Option B didn’t feel as tempting due to the higher premium and costly specialist visits.

Ultimately, based on our ability to self-insure with our emergency fund, our great health, and the monthly savings, we went with Option A. I knew it was risky, but felt the savings were worth it. However, to hedge our bets, I elected to get accident coverage, for a small additional fee (under $10 per month).

And then a month later, I broke my ankle and blasted through my deductible in three weeks.

The accident (and why you should never break a bone on a Friday night)

On a Friday night on the first of September, I was gleefully making my way around a roller skating rink with several of my closest friends to celebrate a friend’s birthday. We were still riding the Barbie wave (think pink, lots of pink), so naturally, it was a Barbie-themed party.

About half an hour into the night, I was testing out my ability to do a crossover turn when it happened. I crossed my right foot over my left, and instead of picking up my left leg to finish the turn, it just kept rolling underneath me. I came down hard on my right ankle.

Time slowed down as I fell, long enough to hear a distinct crack that I’d desperately hoped was just the sound of my skate hitting the slippery rink.

Maybe it’s a sprain…?

Two friends quickly came to my rescue, helping me off the rink and out of my skate. I clung to the hope it was just a bad sprain. I couldn’t put any weight on it without searing pain and was starting to feel nauseous. I laid down with my feet up, and my friend who I’d arrived with offered to drive me to urgent care.

I sat in the passenger seat holding my leg, crying because I felt silly and anxious about what this mistake was going to cost. The urgent care turned us away because they didn’t have an X-ray machine, recommending the closest ER.

We tried desperately to find urgent care with an X-ray machine that was open at 7:30 p.m. on a Friday night. We quickly realized the emergency room was my only option.

Accepting my fate

The tears fell hot and fast and I felt my anxiety rise as I thought about the cost of being in the ER. I was reminded of my early 20s when I had no health insurance. I desperately hoped I’d never have to see the inside of an ambulance, much less an emergency room.

While my situation is objectively different now—I have $20k in an emergency fund AND health insurance. But, I still felt that familiar creep of dread about medical costs. It was emotional and a surprise to realize how long it takes to shake off that kind of financial anxiety.

As reluctant as I was, my friend drove me to Foothills ER. I got the confirmation that I’d cracked my fibula and may have also dislocated my ankle. They splinted me and sent me home, saying I’d need an orthopedic surgeon to review my injury.

Orthopedic urgent care for the win

Here’s my first piece of advice: If you break your ankle, make sure it’s not on a Friday night. And then, if you can, find an orthopedic clinic that takes urgent care patients. It’s thousands cheaper than the ER and they can tell you right away if your break is surgical.

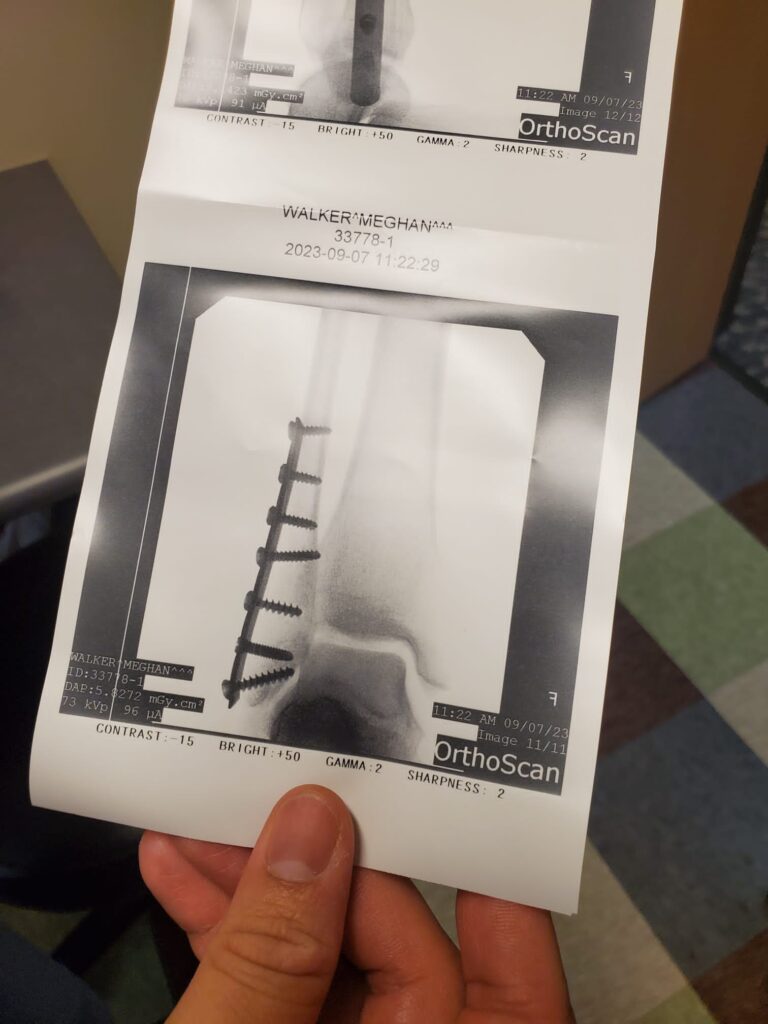

The next day, I went to a local orthopedic clinic that takes walk-ins and costs $250 for an X-ray and consult. The orthopedic surgeon on call confirmed I’d need surgery, recommending a plate and screws to patch up my fibula.

My heart sank as I remembered my sky-high deductible, realizing how much this whole ordeal was going to cost me. In some ways I felt slightly comforted that I knew exactly how much I’d be paying—$6,350. I also felt devastated and incredibly stupid for compromising my health and finances for something as silly as roller skating on a Friday night.

The aftermath

Fast forward a couple of weeks: I’d had the surgery—which went smoothly aside from vomiting several times upon waking up from general anesthesia—and I was at home recovering.

I was non-weight-bearing for six weeks, somewhat housebound due to the injury being my right ankle (no driving!). I had been telling my former boss about my ordeal and how much it costs to break a bone. Then he mentioned he was grateful he had accident insurance.

“OMG,” I told him, “I have accident insurance!!”

I couldn’t believe it: I’d bought accident insurance and had completely forgotten about it until he mentioned it.

I quickly filed a claim, which offered reimbursement for several things:

- ER visit (which ended up being nearly $5,000 for two hours of care)

- Orthopedic clinic visit and X-ray

- Surgery

- Medical equipment like the hands-free crutch I used (and would highly recommend to anyone with a non-weight-bearing foot or ankle injury!)

In all, I got over $4,000 back. That nearly filled up the hole in our emergency fund left behind from the deductible.

3 steps to help you choose the right health insurance plan

While breaking my ankle and dropping over $6,000 for medical expenses in a matter of weeks was certainly stress-inducing, I’m at peace with everything that happened. After berating myself initially for my decision to go with Option A, ultimately I think it ended up working out better than I could have imagined, thanks to accident insurance.

Here are some takeaways that I’m going to think about the next time I need to choose my health insurance plan,

1. Do the math

First, take the Shen approach, and figure out what each premium will cost you each year. Take a look at what you spent in the past year on specialist visits, and decide for yourself if that type of care is a deal-breaker for you. Run through every scenario for each plan, helping you understand how much you’ll be spending if you choose to see a therapist or PT regularly throughout the year.

2. Determine your ability to self-insure

I went into choosing Option A thinking I’d self-insure if need be, and immediately got hit by a $6,350 deductible.

Let’s do a little more math: The full cost of our yearly premium plus the full deductible was $8,618. My total accident insurance reimbursement was $4,300. So, even though I paid my full deductible and premium in one year, the total cost of my accident was $4,318.

That’s all still cheaper than Option B, which would have cost me $5,265 for the premium alone.

We were fortunate to have an emergency fund to cover the initial $6,350—that was crucial in giving me peace of mind.

Consider your emergency fund. Do you have enough to cover your deductible should you break a bone roller skating with your buds? If you don’t, prioritize adding to your emergency fund so you aren’t stuck with a massive bill and no way to pay it.

3. Purchase accident insurance

Even if you’re getting a lower-deductible plan, consider purchasing accident insurance. It’s very affordable and can help lessen the blow of a major unforeseen accident or surgery. It made a massive difference in my financial situation—having $4,000 drop in my account after my claim was processed felt like Christmas morning.