A friend recently equated her credit score to the adult version of the report card. She’s not wrong.

Our credit scores, for better or worse, are a glimpse into our perceived responsibility as an adult. Whether you want to buy a car, rent an apartment, or get a new job, your credit score could be the determining factor.

This article is going to dig into credit scores: Specifically, the factors that influence them and how to raise them. I’ll also tell you how I raised my score from the mid-600s to 800+ in just a few month’s time.

But first, let’s discuss why a good credit score helps you on your path to financial independence.

Do credit scores matter for financial independence?

Short answer: Hell yes they matter. For the longest time, I avoided getting credit cards. I thought that through avoidance, I’d be saving myself from debt and turmoil.

Turns out, I was not doing myself any favors through avoidance.

A high credit score will help you reach FI for several reasons. Let’s look at a few.

Lower interest rates on big purchases

While one of the tenets of financial independence is avoiding large purchases, there are assets that many of us want and need in our lives. Purchasing a car, buying a home, and even renting an apartment all depend on a high credit score.

Not only does your approval hinge on your credit score, but it can also determine what interest rate you will pay.

Access to money-saving lines of credit

One of my most exciting discoveries on this path to FI is travel hacking. Credit card rewards can lead to incredible savings on travel, and having a higher credit score will allow you to qualify for high-value cards that can rack up enough points for trips around the world.

I’ll do a post later on about how my husband and I are traveling for (almost) free these days thanks to credit card rewards.

R.E.S.P.E.C.T.

I definitely have some qualms with the weight that credit scores carry in our adult lives, but a higher score will earn you more respect when it comes time to rent a house or apply for a job. While not every landlord or employer will check your credit score, it can be a major red flag if you have a score that’s below average.

Before we dig into the factors that influence your score, let’s look at what constitutes a “good” or “bad” score.

What’s considered a “good” credit score?

Credit scores range from 300 to 850, and the majority of people sit somewhere in the 650-800 range.

Here’s how Equifax breaks it down:

- 800 to 850: Excellent.

- 740 to 799: Very good.

- 670 to 739: Good.

- 580 to 669: Fair.

- 300 to 579: Poor.

Okay, here we go.

The big players: credit score factors you need to know about

There are several major factors that influence your credit score, and they carry different weight. I’ll break them down into three categories: Low, medium, and high impact. We’ll start with the heavy hitters first.

High impact: Payment history

Payment history is one of the largest factors that influence your credit score. Even one missed payment can make a huge dent in an otherwise healthy score. Here are some important notes on how missed payments hurt your score (from Credit Karma):

- A single 30- or 60-day missed payment is easier to recover from, but will still create a big drop in your credit score.

- A 90-day missed payment will be more damaging and could fully disqualify you from some loans.

- After 90 days, missed payments can be sent to collection agencies.

If you’ve missed some payments, don’t despair; I’ll include some tips on how to offset this later on.

High impact: Credit utilization

Credit utilization is another high-impact factor for your credit score. Credit utilization is the percentage of credit you’re using of your overall credit availability. For example, if you have a limit of $15,000 (based on all your credit lines added together) and you have used $4,500 spread between your credit lines, your credit utilization will be 30%.

Here are some things to remember with credit utilization:

- Keep your usage as low as possible—ideally under 30%. I aim for zero, paying off all my cards each week. Contrary to what you may have been told, you do not need any credit card debt to build credit.

- Credit usage on each individual card is most impactful, but your overall usage is also important. So, if we were to take the example above, say you have three credit cards, each with a $5,000 limit. If you max out one of those cards but keep the others at zero, your credit will still be negatively impacted by the 100% usage on a single card. However, if you were to spread that $5,000 among the five cards, the overall negative impact on your credit will be less significant.

There are some easy ways to improve this area of your credit, which I’ll explain more below.

High impact: Derogatory marks

Derogatory marks are about as bad as they sound—these refer to any debt that has been sent to collectors or public records such as bankruptcies or tax liens. It’s best to avoid these at all costs because they can stay on your credit report for seven to 10 years.

However, derogatory marks aren’t necessarily the kiss of death they may seem.

I have a confession: I had a derogatory mark on my credit that made a massive impact on my credit score, but I successfully had it removed. More on that later.

Medium impact: Age of credit

The age of your oldest credit line has a medium impact on your credit score. There are some important takeaways to consider here.

- Keep your oldest lines of credit open, even if you aren’t using them. However, don’t let them sit unused in your old wallet for too long: Creditors can close dormant accounts. One way to keep old cards alive is to dedicate them to a certain cause, such as fuel or groceries. Just remember to pay it off each month…

- Paying off large loans can cause your credit to drop because it means you’re losing an old line of credit. This happened to me when I finally paid off my student loans. It was my oldest line of credit (18 years) but when I made my last payment, I was disappointed to see a ding in my credit afterwards. This is pretty easy to recover, but keep in mind that it can happen. Pay off your loans anyway, even if means you’ll lose a couple of points.

Low impact: Total accounts

The total number of accounts you have open is another factor on your credit, albeit a lower impact one. While there’s no perfect amount of credit lines to have open, it’s good to have some diversity (think: credit cards, student loans, a mortgage).

Similar to the credit age, when you pay off a loan and it drops off your report, you may see a couple of drops in your score.

Low impact: Hard credit inquiries (aka “hard pull”)

Whenever a new creditor does a “hard pull” or makes a hard inquiry on your credit, you will see a couple of points drop. It’s a temporary drop and typically is recovered within three months.

If you know you’re going to make a large purchase in the coming months such as a house or a large car loan, avoid hard pulls in the previous nine to 12 months. They can stay on your report for up to two years, but their effects are diminished after awhile.

Keep in mind that there are also “soft pulls” which allow potential creditors or landlords to view your report without making a hard inquiry. If you are applying for an apartment and know that the landlord will be checking your credit score, you can request that they make a soft pull rather than a hard one to avoid any damaging effects on your score.

Similarly, if you’re buying a house in the coming year and want to shop around for mortgages, be sure that potential lenders are making soft pulls rather than hard ones until you choose the lender you know you want to work with.

How to improve your credit score

If this is overwhelming so far, hopefully this section will help distill some information for you to start improving your score. I’ll go through each high-impact factor and provide some advice on how to help you raise a sinking score.

Payment history: The saturation effect on your credit score

Missing payments can wreak havoc on your credit score. Fortunately, I’m going to tell you about a great way to turn it around.

If you’ve had some missed payments, the first thing to do is ensure your cards are all set to automatic payments. This is the best way to avoid another missed payment in the future, and will help you get started on the right foot with recovering your score.

Next, work on opening new lines of credit. While I wouldn’t recommend rushing out and opening five new credit cards, start with one or two and then set up automatic payments on those.

Eventually, the number of on-time payments will start to saturate your credit score in a positive way.

For example, say you opened a card in 2015. By 2020, you’d have a credit history of five years, and in that five years, you had 60 months of payments on one line of credit (5 years x 12 billing cycles = 60). And say that you missed seven payments during that time. That’s a considerable amount of missed payments; about 12%.

Let’s look at the following scenario, assuming you opened two new cards in 2020 to help offset your missed payments.

- Credit card #1: Opened in 2015. Total of 7 years or 84 billing cycles

- Credit card #2: Opened in 2020. Total of 2 years or 24 billing cycles

- Credit card #3: Opened in 2020. Total of 2 years or 24 billing cycles

- By 2022, a total of 7 years or 132 billing cycles

So at the end of seven years and 132 billing cycles, those seven missed payments will only account for 5% of your payment history. Over time, that saturation effect will help reduce the impact of those earlier missed payments and your score will rise.

Credit utilization: Pay off your card often and raise your limit

There are two primary ways to improve your credit utilization. First, paying off your card in full as often as possible (before the end of your billing cycle) will keep your usage low. I pay all my cards off weekly which keeps my utilization at about 0%.

The second way to keep your utilization low is by raising your credit limit but keeping your spending the same. Many times, a simple request to your creditor will be enough to raise your limit.

The trick is, don’t spend any extra money on that card. If your spending stays the same but your overall credit limit rises, your usage rate will shrink and voila, more points for that score.

Derogatory marks: The power of a letter on your credit score

Derogatory marks can be one of the hardest factors to positively influence. They are highly impactful on your score, and as mentioned above, can take almost a decade to clear.

But all is not lost if you have a derogatory mark. Here’s how I raised my score from the mid-600s to over 800 with a simple letter.

Student loans: Missed payments, delinquencies, deferments, oh my!

When I was in my early 20s, I took out student loans to pay for school. They weren’t astronomical, but they allowed me to study without having to work full-time.

By the time I left university, my loans hovered around $20,000. I vacillated between paying the minimum amount due and putting them in economic hardship deferment, typically while I was travelling and not working.

Most of my loans were Perkins and federal student loans. I had two Perkins loans from two different universities; one was from Western Washington University and the other, the University of Washington.

At some point, my loans from the UW were transferred to Mohela, a student loan servicing company. I still paid off my Perkins loan from WWU, and those were my two primary student loans payments.

Fast-forward to mid-2021. I was $500 away from making my last student loan payment, when I finally did a deep dive into my own credit.

WTF is up with my credit score?

I’d been confused because my credit score just seemed to keep falling, despite not having any credit card debt. When I finally took a closer look at my score, I was horrified to find a had a derogatory mark on my credit and almost a year’s worth of missed payments.

Here’s what happened: I thought all of my UW loans were consolidated into my Mohela account, but that wasn’t the case. My Perkins loan from UW for $1,000 that wasn’t rolled into Mohela, and it had been sitting in purgatory ever since it went back into repayment in 2019. There were over a dozen missed payments, and the loan was now sitting in collections.

I was horrified. I went through every correspondence I could find, and it took quite a few phone calls before I finally got someone on the phone who could help me. As it turned out, there was very little I could do to rehabilitate the loan. Because it was in collections, it was out of their hands, so I thought.

My Hail Mary

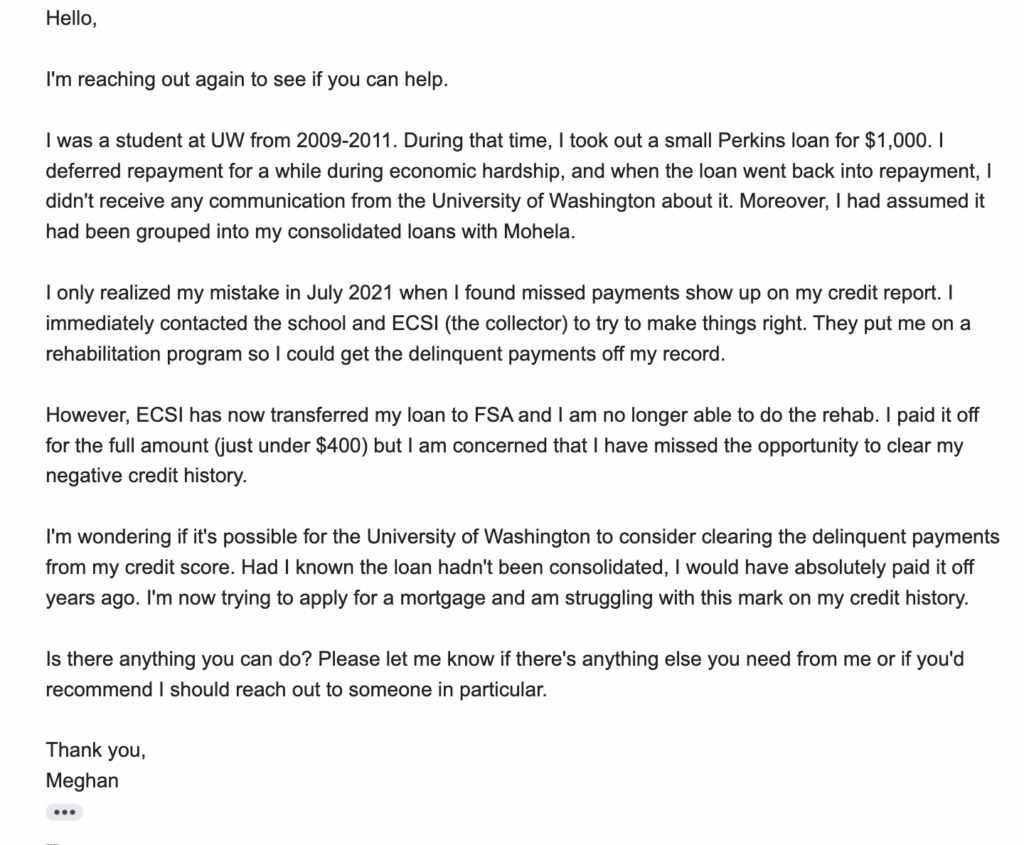

I made one last attempt at making things right by emailing the University of Washington. Below is my letter.

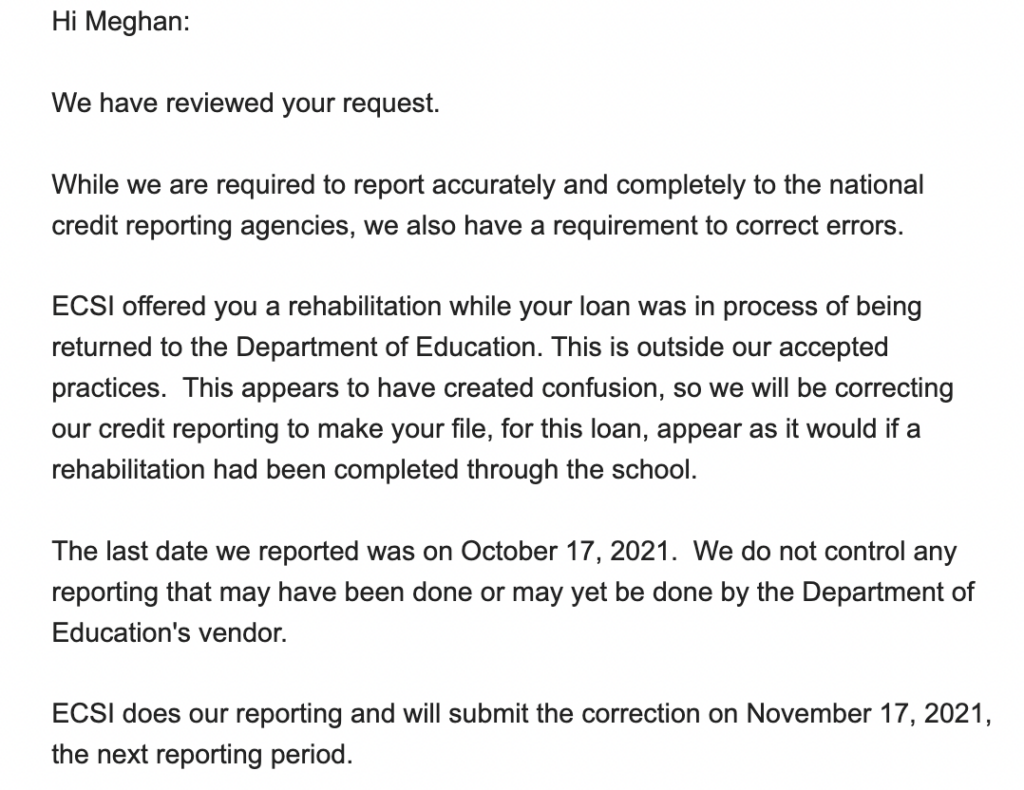

And it worked.

A wonderful man named Brian responded saying that due to some errors on their end, they were willing remove the derogatory mark and correct my missed payments.

Now, I know this is a unique situation, but I’m sharing it to offer hope to those of you who are dealing with a similar scenario. Getting my credit score corrected took a lot of effort, but it helped me raise my score by over 100 points almost overnight.

How much energy should you put into raising your credit score?

It can be a harsh reality check to do a deep dive into your credit score, especially if it’s sub-par. I recommend focusing on one high-impact area at a time to help improve your score.

Keep in mind that if you don’t have any big purchases or moves coming up, this is a great time to work on improving your score.

A note of warning: Be realistic about what cards you apply for because if you apply for a high-value card like Chase Sapphire Preferred and get denied, this will suck a few points out of your score and leave you empty-handed. (This happened to me four years ago, but I’m happy to report I qualified for the Sapphire last year after some serious credit score rehabbing.)

I’m happy to answer any questions you may have about credit scores; leave comments below and I’ll do my best to help.