One of the most significant hurdles to financial independence is debt. After all, the average consumer debt in 2022 is a staggering $92,727.

Debt can feel shameful, embarrassing, and impossible to manage. In this guide, I’ll lay out some tips and strategies for eliminating your debt and moving on with your financial life.

Take stock of your debt

This can be a brutal awakening for some. I know that when I was in the depths of my debt, I consciously avoided checking my balances because they caused me so much anxiety.

This obviously did nothing to help eliminate my debt, but it was very effective in making me even more stressed out.

At the height of my debt, my partner and I were living out of the van we’d just spent our life savings to build. We were living off my (meager) income as a writer and making the minimum payments on about a half dozen different credit cards and my student loans.

It was a temporary situation as we knew we’d eventually settle somewhere and go back to having two incomes, but at the time it was the best we could do with the resources we had. It was a conscious choice to let the debt accumulate while we frolicked through the west on a six-month climbing trip, but it took its toll on my credit score.

When we finally settled in Boulder and sold our van, we made it our first priority to get rid of our debt.

Here’s what worked for us.

Make a list of each credit card, its balance, and interest rate

This was the real come-to-Jesus moment for us, and one that was equal parts stressful and empowering.

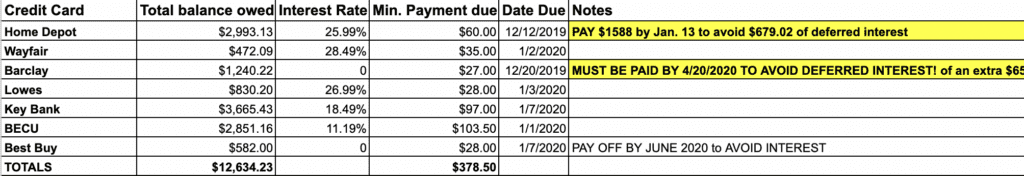

Here’s an example of the spreadsheet I made to help me make sense of it all:

As you can see, the total we owned was nearing $13,000, and that wasn’t even including the $10,000 I still owed on my student loans.

Prioritize paying off the cards with the largest interest first

As you can see in the example above, Wayfair had the highest interest rate at 28.49%. The total balance owed was relatively low at $472, so we took that one out in one fell swoop.

Next, we tackled Lowe’s, which had an interest rate of 26.99% and a balance of $830.

With those two out of the way, we then set our sights on our Home Depot card and Key Bank loan, with roughly the same cadence.

Pay the rest off as soon as you possibly can

This is where some of the challenges arose: While we had gotten rid of the worst cards/credit accounts first, we still had a decent amount of debt to chew through. We were paying as much as possible based on our financial requirements at the time, but by no means did we get out from under our debt quickly.

The crux for us was in our spending: Rather than choosing to buy things or go out to dinner, we looked at paying off our debt like we were buying our financial freedom. I knew how much debt would hold us back, and didn’t want to live in that reality.

Now, our debt wasn’t astronomical: At its worst, it was close to $25,000 with my student loans added in.

But with this strategy, we paid our debt off in less than six months.

What about student loan debt?

Now, this is a tricky one.

I was fortunate that I didn’t have staggering student loan debt as do many of my peers, and my husband Callan has no student loan debt. Once my credit cards and loans were paid off, student loan debt was the next hurdle. I would put upwards of $500 a month into my repayment, a strategy that was pretty painful at the time but paid off immensely.

If you’re in a situation in which student loan debt is in the hundreds of thousands, even sinking $1,000 a month isn’t going to make a sizeable dent in your balance.

I’d recommend putting as much energy as you have into finding ways to access debt forgiveness.

This article has some great options such as teacher loan forgiveness, public service loan forgiveness, and others.

Where am I now?

Right now, I have zero credit card debt. Here’s what I chose to do with each of those cards after eliminating my balances:

- Home Depot: I chose to hold onto this card, partly because I’d had it longer than the others and wanted to keep it on my credit history. Plus, my husband is a carpenter, which means never-ending projects.

- Wayfair: I closed this account. It had a huge interest rate, and I don’t buy from this site often enough to justify it.

- Barclay: I kept this credit card open, again for the credit history. I have one expense that I pay with it each month to keep it active: Netflix. It’s set to auto-pay, so I don’t have to think about it.

- Lowes: I closed this account, because we shop at Home Depot more often, and the interest rate was quite high (nearly 27%).

- KeyBank: I kept this account open, again for credit history. I try to use it every once in awhile to keep it active.

- BECU (Credit Union): This was a small personal loan I took out to help pay for our van build-out. Once I paid it off in full, the account automatically closed.

- Best Buy: I closed this account because I don’t shop often at Best Buy, and the account hadn’t been open long enough for it to make an impact on my credit history.

Nowadays, I have a totally different line-up of credit. I’m not fully debt-free, however: I have roughly $2,000 left on a car lease (which you can read more about in this budgeting article).

Current lines of credit

My current credit cards/lines of credit:

- Chase Sapphire: I use this card for all of my expenses, aside from rent and a few utilities. I tend to pay it off weekly to keep my credit utilization low.

- Chase United Explorer: I recently got this card and am using it all the time right now to hit the minimum spend to get the rewards.

- Barclay: As described above, I only pay for Netflix with this card.

- KeyBank: I hardly use this card but keep it for credit history.

- Car lease: This will be paid off in May 2023.

I keep my credit utilization as low as possible to keep my credit score high, which means I essentially finish each billing period with a zero balance. (We’ll dig into credit scores in a later article!)

How to think about debt

If you’re riding the line between managing sizeable debt while also investing your savings, I want to challenge you to rethink your strategy.

Holding onto debt is a net-negative. It’s a financially soul-sucking, credit score-wrecking, HUGE headache that doesn’t get better with time.

Before you get too excited about tossing all that extra coin into your retirement accounts, get real about your debt. If you’re faced with credit card debt, eliminate that first. Car and house payments are more manageable, as are student loans, but tackling credit card debt should be your first order of business.

As Mr. Money Mustache says, “Your debt is an emergency.” Treat it like one.

Think of investing as the REWARD you get for eliminating debt. Your money will start making you money, which is a beautiful transition from dealing with high credit card interest rates.

Being debt-free is the first stage of financial independence.

Featured photo by Alice Pasqual on Unsplash