Stock market dips, bear markets, and recessions are good for the economy. Market drops encourage:

- companies to improve investments,

- workers to stay competitive, and

- governments to implement legislation that improves market safety.

In the same way that short-term struggle (i.e. physical exercise) keeps you and me from getting too soft and squishy, market downturns help the economy stay fit and healthy.

Stock market dips are (not) scary

As a person working towards FI, we are often keenly aware of how stock market fluctuations affect progress toward our FI Number. Because most of our net worth is invested in index funds, I’ve seen single-day market drops “reduce” my net worth by 10s of thousands of dollars.

To the uninitiated, this can be scary! After all, money you keep in cash in savings accounts (at least in the US) is “safe” from downturns because they are insured by the FDIC.

We are not the uninitiated! We know that the stock market historically recovers from these dips. And we know that afterwards, the economy emerges stronger than it was before.

As FI investors, we take a long-term view of the market. We do not pin our definition of success to the short-term, or even multi-year stock price. We buy and hold for decades. After reaching FI, we sell only a small portion of our investments to cover our carefully considered living expenses.

Hormetic stress for humans

The obesity epidemic shows us how abundance and easy living actually hurts us in the long run. While constant access to calorie-dense food might feel good in the short run, it can make us obese and more susceptible to disease in the long run.

Intermittent fasting: Between feast and famine

Optimal living lies between feast and famine. Sustained lack of food results in starvation, while unrestrained indulgence in food results in higher risks of:

- Type 2 Diabetes,

- Cancer,

- Heart Attacks, and

- a ton of other diseases that ruin your quality of life and may kill you.

One effective answer is hormetic stress in the form of intermittent fasting.

Hormetic stress, or “good” stress, is defined as:

Controlled, acute stressors that trigger healthy adaptive responses

– Stephanie Eckelkamp

Hormetic stress is not intense enough to cause harm, ie. starvation. And it’s not too long-lasting so that it becomes “chronic”.

Intermittent fasting (or “IF”) is when you create an eating window of four to eight hours per day. During your eating window, you eat. When your eating window is over, you don’t eat. Simple.

Benefits of intermittent fasting

Denying your body food a few hours each day has a few positive results including fat loss and autophagy. Allow me to digress briefly to chat about autophagy: It’s a near-magical process in which your body cleans up old weak cells, parts of cells and misfolded proteins.

Autophagy is linked to better skin and hair, reduced cancer risk, and even reversing early stages of Alzheimer’s.

Autophagy is a process we want to stimulate as much as possible. We get the majority of autophagy’s benefits when we place ourselves in a state of hormetic stress by taking a break from food or when we are exercising.

If this piques your interest and you’d like to dive deeper into fasting check out:

Hormetic stress for the economy

The same is true for the economy. Stress, in the form of dips and bear markets, to the economy and its constituent companies can keep things healthy in the long run.

Stock market primer

The stock market is comprised of every publicly traded company. Indices, such as the S&P 500, track large sets of actual companies. So when we hear that the stock market “is down”, they mean average stock prices of the companies in the stock market or an index are down.

A company’s goal/obligation is to provide value to its shareholders. A drop in stock price sends a message to company leadership that shareholders don’t approve of the direction of the company.

Share-price decline places real stress on the companies affected.

Stock price’s major impact

According to the Harvard Business Review, more than half of corporations’ upper-level management compensation in large companies is made up of stock and stock options. This effectively ties the stock price of a company with its executive’s wallets.

If a company’s stock performs badly enough, shareholders can exercise their rights as part owners of the company to oust corporate executives.

Additionally, a company’s stock can act as a currency used to make acquisitions of other companies. When its stock price falls, so does its purchasing power.

At the extreme end, underperforming stock can enable a hostile takeover. In short, a hostile takeover is when a prospective acquirer goes directly to the shareholders (subverting the company’s management) to aggressively acquire a company.

Finally, governments are watching for foul play and can levy fines and enact legislation in response to major market recessions.

Stress encourages change

Given the stress imposed by stock price fluctuations, how do companies, individuals, and governments respond? How do these responses result in a stronger economy in the long run?

Increase workforce competition

Companies can lay off mediocre employees. In stress-free times when the stock market is going up, the expense and liability of firing under-performing employees may not be deemed “worth it”. One way to increase share price is to decrease expenses. This puts those under-performing employees on the employment chopping block.

This may sound harsh, but increasing competition among members of the workforce ensures that individuals are working to keep their skills sharp. It also encourages people who are just in certain careers “for the money” to go look for work that they are more passionate about.

Divest underperforming investments

Take the automotive industry for example. During times of plenty, auto manufacturers can afford to produce both electric vehicles (EVs) and gas and diesel engines. As consumer preferences, environmental legislation, and the economy change, these same auto manufacturers are divesting themselves of assets tied to gas and diesel engines.

According to a report by Ernst & Young:

Since the days of the combustion engine are numbered, most decision-makers are trying to decouple these [combustion engines and electric vehicle] parts of the business and sell them while it is still possible.

Constantin Gall, Ernst & Young

Governments Improve Legislation

After the 2008 Great Recession, the Federal Government passed the Dodd-Frank Wall Street Reform and Consumer Protection Act. This complex law limits predatory mortgage lending by banks, limits risky investments a bank can hold, and established a branch of the Securities and Exchange Commission (SEC) to improve how investment credit ratings are devised.

If your eyes glazed over in the above paragraph, I don’t blame you. In short, the government took several of the root causes of the 2008 financial crisis and created legislation designed to prevent them from causing another recession. The legislation attempted to (and has succeeded at?) encourage consumer confidence in economic markets generally and banks specifically.

What Should You Do in a Recession?

First off, take a deep breath. Your bank might show that you’ve lost money, but this is just a loss on paper, unless you need to sell.

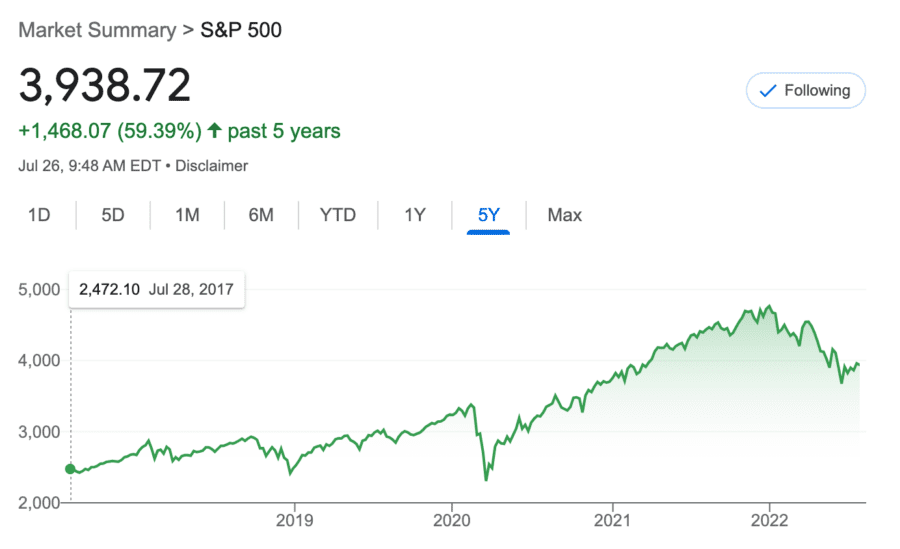

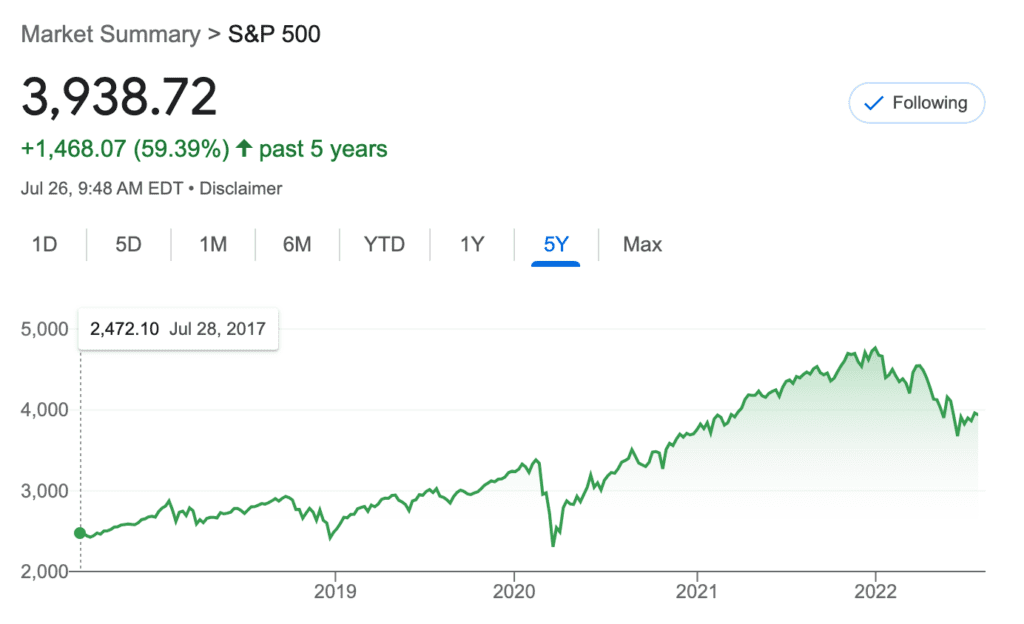

Remember that we’re investing for the long run, so daily, monthly, and even longer downturns don’t really matter to us. It’s all about how the market performs over decades. As we can see below, even though the S&P 500 is down (considerably) this year, it’s up nearly 60% over the last five years!

You could lose money if you sold in a panic during one of the several downturns or mini-recessions we’ve had during this time period. But if you avoid that and just did nothing, your paper-loss would turn into a paper-gain shortly thereafter.

Conclusion

Of course, without stock market dips and recessions, companies still invest, still create competition in the workforce, and governments still create legislation. Market contractions and individual stock price drops serve to accelerate these changes and squeeze out less competitive practices.

While there are downsides to recessions—big companies tend to outlast smaller competitors, good employees are fired when companies downsize, and not all legislation is effective legislation—market contractions encourage change and health in the economy.

As FI people, we invest for the long term and get to simply ignore these downturns!