I’m putting pen to paper because this is the single largest piece of information that was missing from my financial knowledge. Not only was the concept of investing scary and confusing, but I didn’t know how to open an investment account, or what kind of investment accounts were even available to me.

That’s why this post is dedicated to the uber-newbies out there. I’m going to share how I do my investing each month through my Fidelity account.

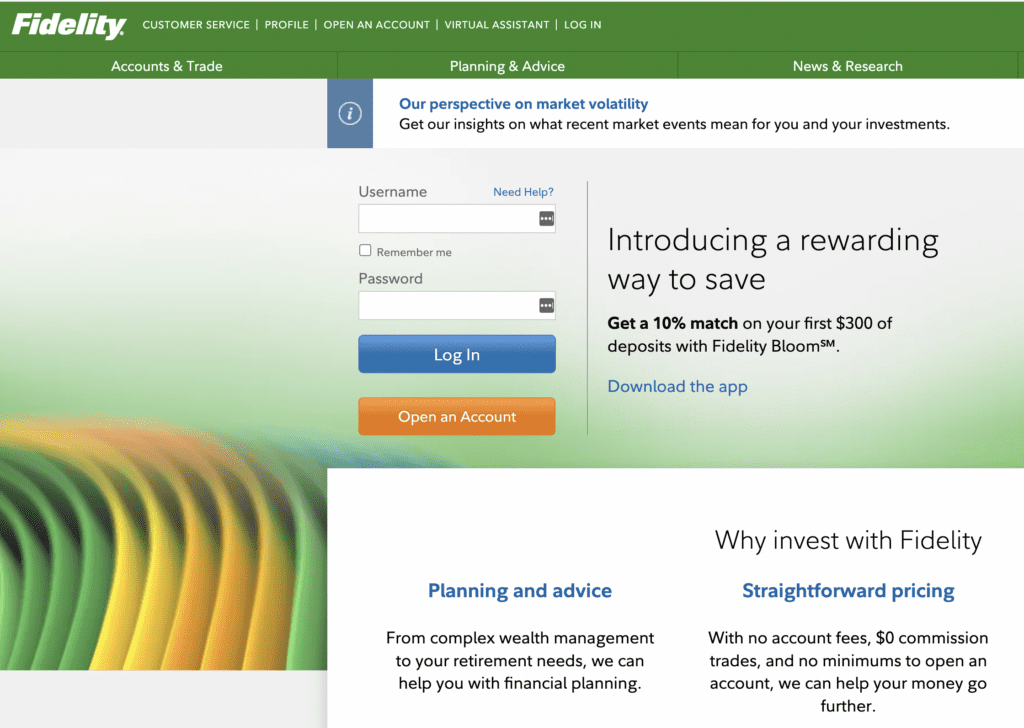

Step 1: Open an account with an investing company

There are plenty of options here, but some of the heavy-hitters include Fidelity, Vanguard, and Schwab. I personally use Fidelity, but I also think Vanguard is an excellent choice for its customer-owned operation model.

Because it’s my personal investing platform, these instructions will be all focused on opening an account with Fidelity.

So, first step; click the orange “Open an Account” button and get rolling.

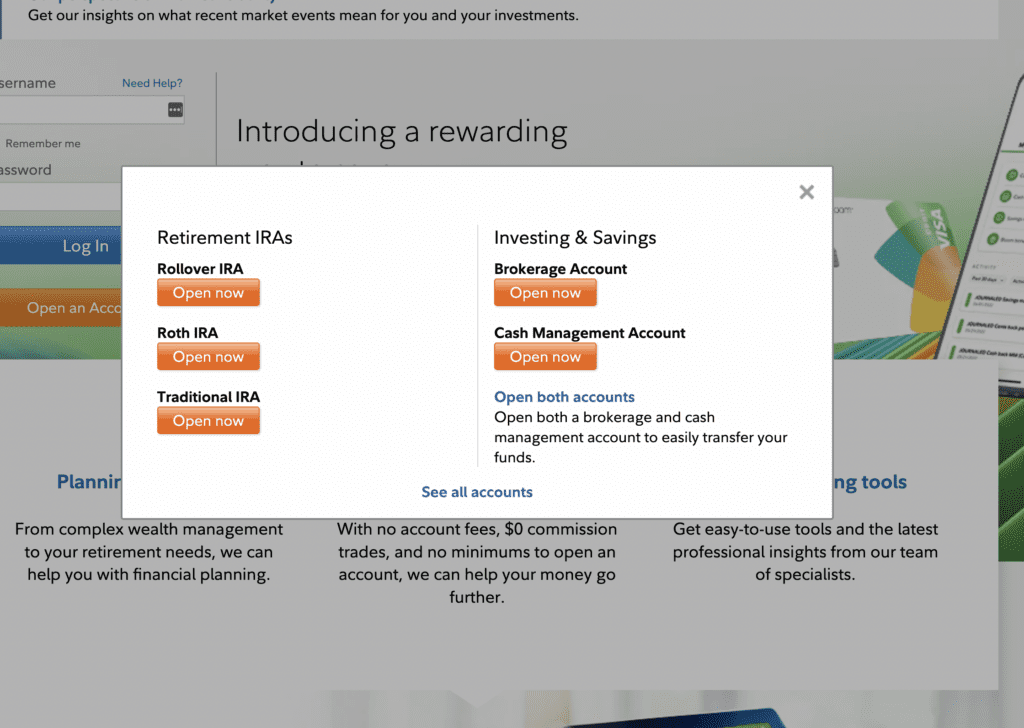

Then, a pop-up will appear asking you what type of account you want to open. If this is your first rodeo, a Roth IRA will be your best option, as long as you earn less than $144k per year. If you earn over $144k a year (fist bump), select Traditional IRA.

More on Roth IRAs in a moment, but for now, let’s keep going.

The account creation process will lead you through a few steps, including adding your personal information and creating a username and password. Once you’ve successfully opened a Roth IRA account, you’ll be ready to transfer money into your account.

(If you run into any issues while setting up your account, Fidelity has pretty top-notch customer service that can walk you through it.)

Step 2: Link your bank (and set up automatic contributions for your investments)

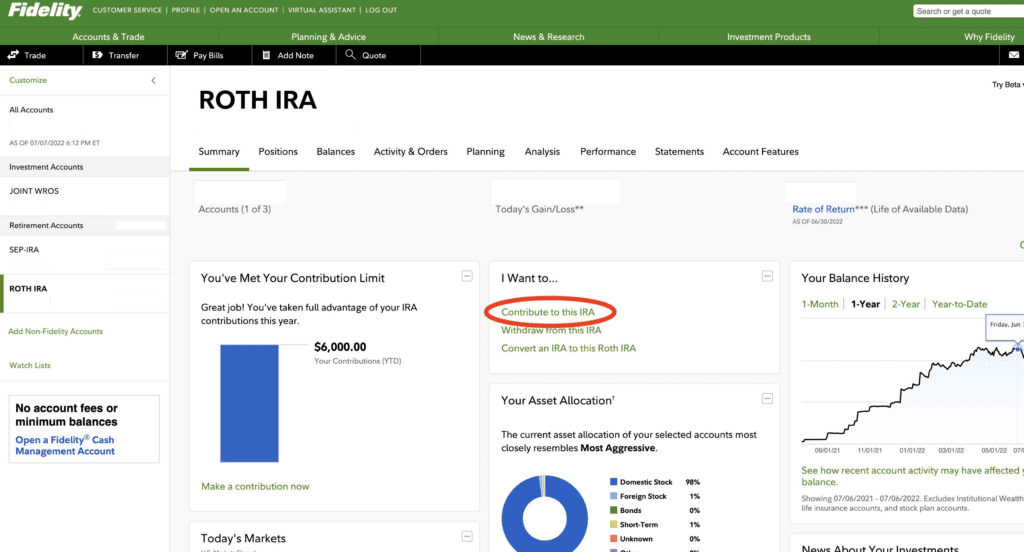

You’re in! Now you need to start adding some money to your Roth IRA account.

The easiest way to do this is to connect your primary bank account to your Roth IRA. To do this, open your Roth account (located on the lefthand side of the screen), and then click “Contribute to this IRA.”

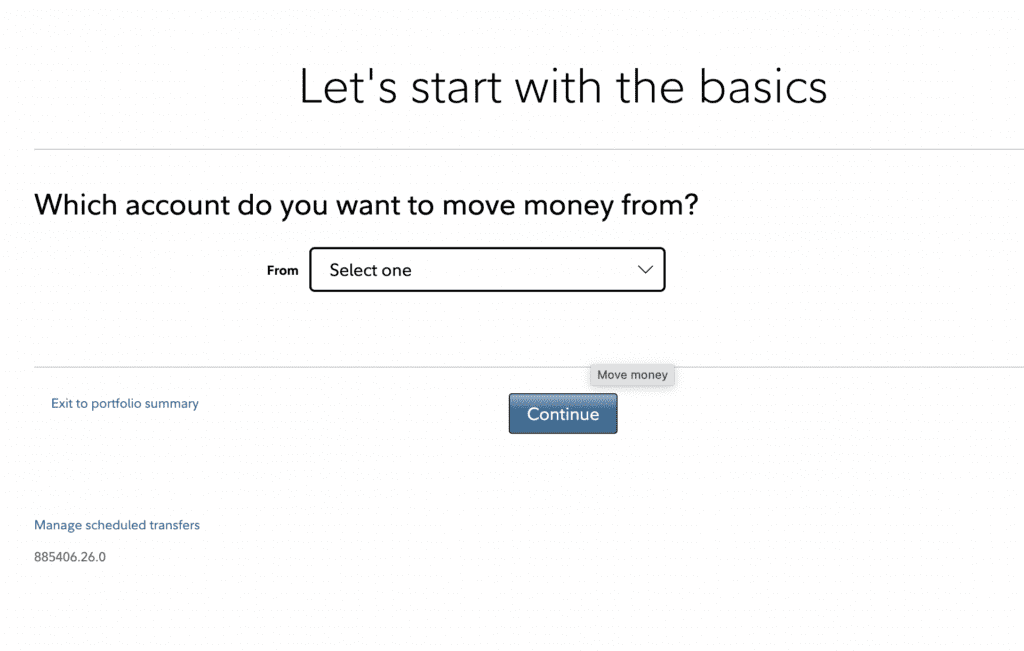

You’ll be prompted to move money from a drop-down list of options. Click “Link a bank to a Fidelity account,” and proceed to add your banking details.

At this point, I think it’s highly beneficial to set up automatic contributions to your Roth IRA. Note that there’s a $6,000 yearly limit for Roth IRA contributions, so it may make sense for you to spread that out over a year. While the cadence of adding money to your account is up to you, it’s often in your best interest to max out this puppy each year.

Step 3: Choose (and make) your investments

This is a crucial step, and one that I’ve heard horror stories about. While adding money to your Roth IRA is great, if you don’t invest any of it, you’re essentially just letting it sit in purgatory. Don’t let this happen! I schedule my investments the minute I schedule money transfers so I don’t forget to invest.

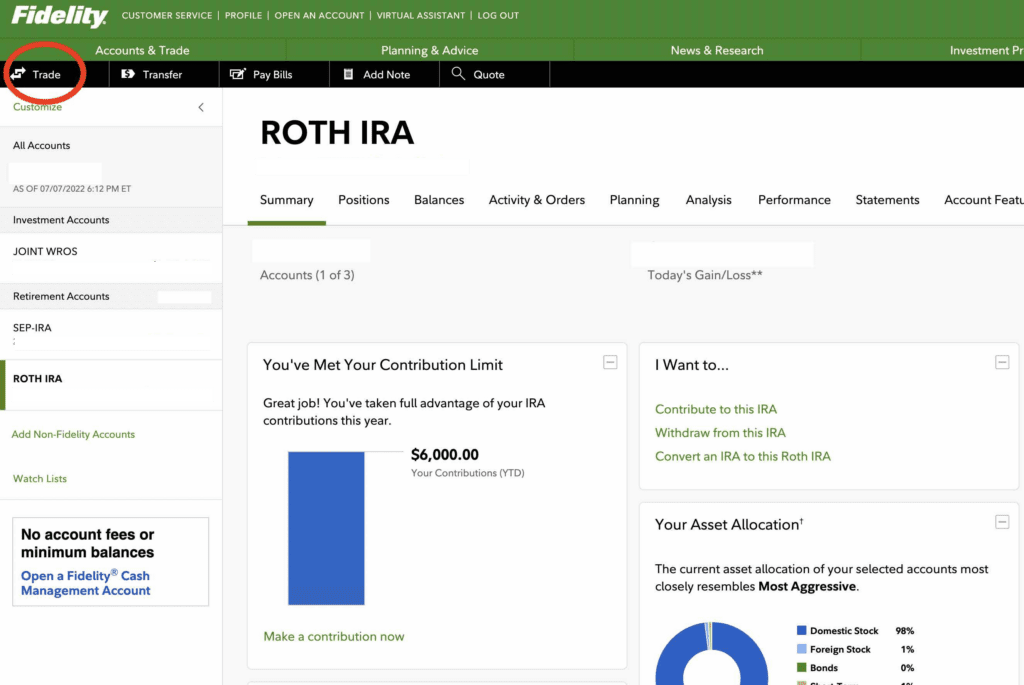

Once you have a nice wad of cash sitting in your shiny new Roth IRA account, click on the “Trade” button on the top lefthand side of the screen.

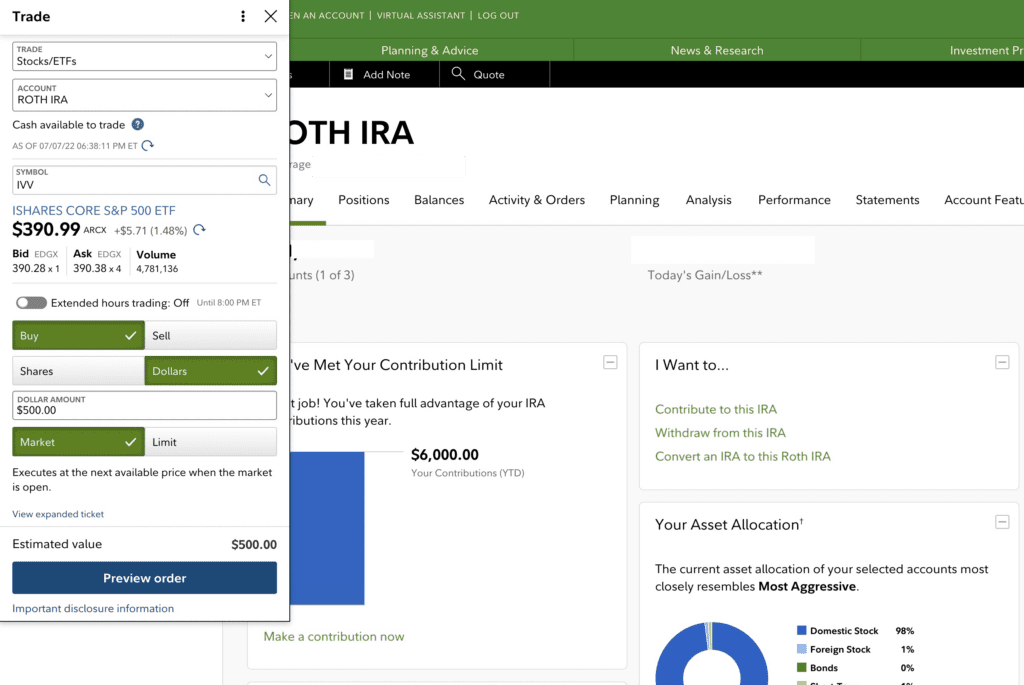

Next, you’ll be prompted with a trading menu as shown below.

Here, you have options. I choose to invest in IVV (shout out to Jeff for the recommendation!), which is an index fund. It’s important to do your own research here, but as J.L. Collins says, index funds are for people who want the best possible investing results.

Then, you want to select “Buy,” “Dollars,” and “Market,” and choose an amount—ideally, the amount you just transferred from your bank account. Here, I’ve entered $500 as an example.

Then, hit “Preview Order” to ensure everything looks correct, and finalize. Note that you can only trade between 9:30 am and 4 pm ET.

Step 4: Invest regularly, ideally with as much of your income as possible

As someone who is trying to quickly catch up on my FI savings, I’m contributing about 50% of my income each month to my investment accounts. Here is how my investments break down:

Roth IRA

This is an excellent retirement account for everyone to own as long as you don’t exceed the income max ($144k per year in 2022). By contributing post-tax income, you’re allowing money in this account to grow tax-free. There are plenty of other handy things to know about Roth IRAs; this HerMoney article is a great resource.

I max out my Roth IRA each year and invest in IVV index funds.

Roth 401(k)

A 401(k) is a retirement savings account offered by many employers, often with a matching contribution of around 4%. My company does this, so I take advantage of it by maxing out my contribution in each paycheck.

My 401(k) is managed through a company called The Standard, but I’m able to choose my investments. I invest in Schwab’s SWPPX, their S&P 500 Index Fund.

A quick note on Roth vs. Traditional 401(k)s: I chose to open a Roth 401(k) because I want to contribute post-tax to my account. While a Traditional 401(k) would allow me to skip out on paying taxes when I contribute, I’d rather pay taxes on today’s tax rates than take a gamble at what those rates may be when I choose to start withdrawing.

I’ll be hitting the max contribution level for this retirement account, which is $20,500 for 2022.

SEP IRA

As someone who has a side-hustle, I also qualify for a SEP IRA. This is a great account for all the freelancers out there to open; it has a high contribution limit ($61k for 2022), and can mimic a 401(k).

After maxing out both my 401(k) and Roth IRA, I split the remainder of my investments between my SEP IRA account and I Bonds.

Series I Bonds

I Bonds are a bit of a dark horse at the moment but are a great option for folks who want to diversify between stocks and bonds. While there are a number of bond options out there, I chose I Bonds because they have a relatively high return rate of 9.62% through October 2022.

The downside of investing in I Bonds is navigating the Treasury Direct website. It’s old and cumbersome, but worth setting up if you want to take advantage of the high return rate.

Keeping track of investments

Once you have your investments happening on a regular basis, it’s wise to come up with a system that allows you to track everything.

A simple spreadsheet will probably do the trick for most. Better yet, include it in your budgeting app like I do, with contribution “buckets” set aside each month. It reminds me to invest and keeps me honest.

Ride it out, even when things look rocky

One of the biggest pieces of wisdom J.L. Collins likes to impart is this: Ride the wave of the down markets. Collins often refers to the “relentless upward march” of the stock market, as a fantastic reminder that things will bounce back.